do you pay tax on a leased vehicle

How do I buy out my lease early. Also no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas.

4 Ways To Calculate A Lease Payment Wikihow

Instead sales tax will be added to each monthly lease payment.

. You will have to pay taxes on your leased car each year that you have it. If youre considering leasing you may be wondering whether you pay taxes on a leased car. When you lease a car in most states you do not pay sales tax on the price or value of the car.

Leased Vehicles for Personal Use Leased vehicles produce income for the leasing company and are in turn taxable to the leasing company. If you cant find your. Does that mean you have to pay property tax on a leased vehicle.

However the bill is mailed directly to the leasing company since leased cars are registered in the companys name. However you should always check this when you lease a car just to make sure the vehicle is taxed. To do this all you need is the vehicles registration number and the makemodel of the car.

Do You Pay Taxes On A Leased Car. The monthly rental payments will include this additional cost which will. In leasing you agreed to make a monthly payment to use a car.

Tax is calculated on the leasing companys purchase price. In most cases youll owe a percentage of the vehicles value as property tax. If youre unsure about whether your leased car has VED you can check this on the government website for peace of mind.

However the Supreme Court has ruled that GLc. The leased vehicle will be titled in the name of the lessor owner. While most people dont have to pay taxes on a rented property thats not the case with leased vehicles.

Titling Your Leased Vehicle. Buy the car and then sell it At any point during your lease you have the option to buy the vehicle called an early buyout. Sells the vehicle after 10 days use.

Unlike most states for long-term motor vehicle leases New York requires that sales tax be paid upfront based on the total amount of lease payments for the entire lease term. In Virginia you will be taxed upfront on the cost cap of the rented car 6 sales tax rate Fairfax County and then on the 415 tax rate based on the value of the car each year. All tax rules apply to leased vehicles.

After the lessee moved to Florida the following year the leasing bank began charging Florida sales tax on the monthly lease payments. The amount of taxes youll owe on your leased car will depend on the state where you live. This means you only pay tax on the part of the car you lease not the entire value of the car.

All applicable fees are due at the time of titling by the lessor such as the 15 title fee and the motor vehicle sales and use tax. Instead the tax is paid by the retail investor to the Registrar of Motor Vehicles. See Baker Transport v.

When you lease a car in most states you do not pay sales tax on the price or value of the car. In Texas all property is considered taxable unless it is exempt by state or federal law. 64H 3 c.

With a lease you dont pay the sales tax up front. The leasing agreement may require the lessee to make these payments. Registering Your Leased Vehicle.

No tax is due on the lease payments made by the lessee under a lease agreement. State Tax Commission 371 Mass. Instead sales tax will be added to each monthly lease payment.

Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off. Use tax is due. The lease payment and amount of sales tax will be disclosed on the auto lease worksheet.

Do I have to pay tax if I lease a car. If you terminate your lease it is very important that you provide the Tax Assessors with a return of plate receipt or a letter from your insurance company showing the vehicle cancelled. Article continues below advertisement.

64H 3 c does not apply to leasing transactions and that a lessor must collect and pay the tax due on such sales. Sells the vehicle within 10 days use tax is due only from the third party. The leasing company may use the fair market value deduction to reduce the vehicles taxable value.

If you are a full-time student with a vehicle registered in a state that has personal wealth taxes and you are the sole owner of the vehicle you may be exempt. If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure.

Easy Guide To Novated Leases Types Tax And More Finder Com Au

Is It Better To Buy Or Lease A Car Taxact Blog

Subletting Contract Template Free Printable Documents Contract Template Real Estate Forms Being A Landlord

/when-leasing-car-better-buying-v1-735d3e7993d0435c8e1dcc0831af07bc.png)

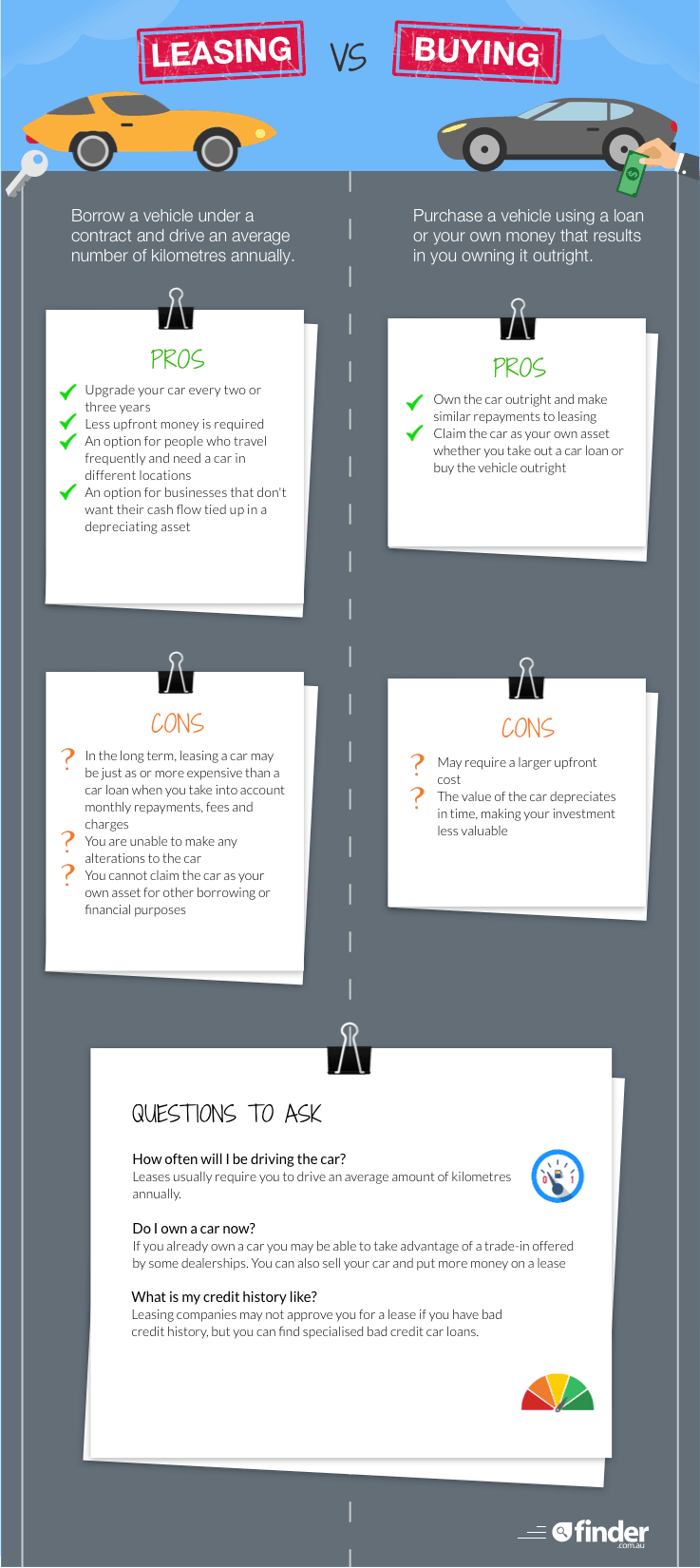

Pros And Cons Of Leasing Or Buying A Car

Novated Leasing Existing Car Maxxia

Lease Payment Example And Lease Payment In Income Statement

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Transfer Bail Auto Break An Auto Lease Effectively Audi Sports Car Audi Cars Audi R8

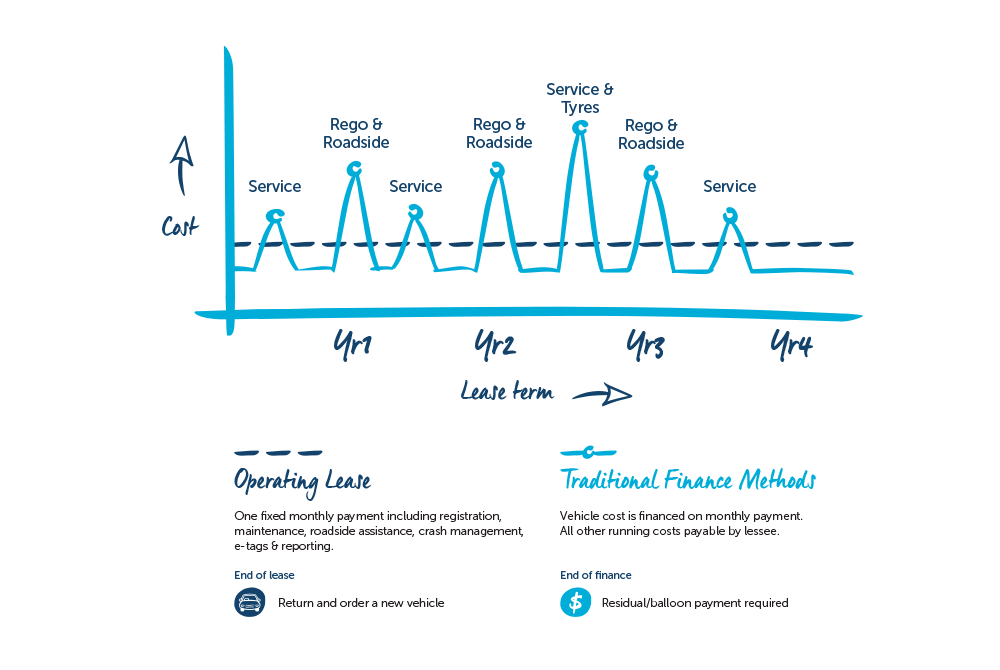

Operating Lease Business Vehicle Finance Fleetcare

Sublease Agreement Template Real Estate Forms Real Estate Forms Business Proposal Sample Agreement

Novated Leasing Existing Car Maxxia

Simple Lease Invoice Template Google Docs Google Sheets Excel Word Template Net Invoice Template Google Sheets Lease

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Is It Advantageous To Think Of Leasing Your Commercial Real Estate Commercial Property Commercial Real Estate Commercial